IL LP 210 2012-2024 free printable template

Show details

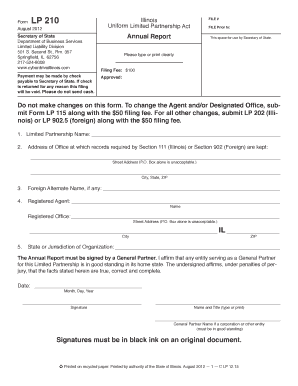

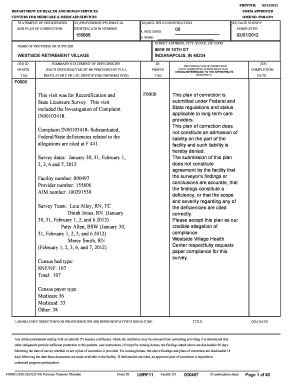

Print Form LP 210 Illinois Uniform Limited Partnership Act August 2012 Secretary of State Department of Business Services Limited Liability Division 501 S. Second St. Rm. 357 Springfield IL 62756 217-524-8008 www. cyberdriveillinois. com Payment may be made by check payable to Secretary of State. If check is returned for any reason this filing will be void* Please do not send cash. Reset Save FILE FILE Prior to Annual Report This space for use by Secretary of State. Please type or print...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your il annual report form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your il annual report form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit il annual report form online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit illinois lp 210 form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

IL LP 210 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out il annual report form

How to fill out IL annual report form?

01

Gather all the necessary information and documents required for the annual report form. This may include financial statements, income and expense records, and other relevant paperwork.

02

Complete the basic identification sections of the form, such as the company name, address, and contact information.

03

Provide details about the company's activities during the reporting period, including any changes in ownership, operational changes, or new projects undertaken.

04

Report the company's financial information, including total revenue, expenses, assets, liabilities, and any changes in equity.

05

Include supporting documentation and attachments, such as bank statements, tax forms, and auditor reports, if required.

06

Review and proofread the completed form to ensure accuracy and completeness.

07

Sign and submit the annual report form by the designated deadline, either electronically or by mail.

Who needs IL annual report form?

01

Any business entity registered in the state of Illinois must file an annual report form.

02

This includes corporations, limited liability companies (LLCs), partnerships, and nonprofit organizations.

03

Filing the annual report form is a legal requirement and helps to maintain the company's good standing with the state authorities.

Fill illinois partnership annual report : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is il annual report form?

IL Annual Report Form refers to the annual report form that must be submitted by certain entities in the state of Illinois, United States. This form is used to provide the state government with important information regarding the business activities and financial status of the entity. The specific requirements and format of the IL Annual Report Form may vary depending on the type of entity, such as a corporation, LLC, or partnership. The annual report typically includes details about the entity's shareholders or members, registered agent, business address, and financial information. It is important for businesses to file the annual report on time to maintain their legal compliance and good standing with the state.

Who is required to file il annual report form?

The Illinois annual report form must be filed by all domestic and foreign corporations, limited liability companies (LLCs), limited partnerships (LPs), and limited liability partnerships (LLPs) that are conducting business in Illinois.

How to fill out il annual report form?

To properly fill out the Illinois Annual Report form, follow these steps:

1. Access the Illinois Secretary of State website: Visit the website of the Illinois Secretary of State (https://www.cyberdriveillinois.com/) and navigate to the "Business Services" section.

2. Navigate to the Annual Report filing: Under the Business Services section, look for the "File Annual Report" option. Click on it.

3. Enter your Business File Number: On the Annual Report page, you will be prompted to enter your Business File Number. This number can be found on previous filings or correspondence from the Secretary of State's office.

4. Verify and update business information: The next step is to verify and update your business information. Make sure your business's name, registered agent, principal address, and other relevant details are accurate. If there have been any changes, update them accordingly. Double-check for any errors before proceeding.

5. Indicate business activities: You will be asked to indicate the business activities carried out by your company during the reporting period. Select the appropriate industry classification(s) that best describe your company's activities.

6. Provide officer/manager information: Enter the names and addresses of all officers/managers associated with your business. This includes directors, president, secretary, and treasurer. Ensure accuracy and verify that all required fields are filled.

7. Disclose ownership or percentage interests: If your business is a Limited Liability Company (LLC) or a Partnership, you will need to disclose the ownership or percentage interests of all members/partners. Add the required information for each member or partner.

8. Provide an email address for annual report correspondence: You will be asked to provide an email address where all future annual report correspondence will be sent. Ensure you have access to this email and that it is regularly monitored.

9. Review and submit: Carefully review all the provided information for accuracy and completeness before submitting the form. Once reviewed, submit the annual report.

10. Pay the filing fee: After submitting the report, you will be directed to a payment page. Pay the required filing fee using a credit card or other accepted payment methods. The fee amount may vary depending on your business structure.

11. Confirmation and receipt: After the payment is successfully processed, you will receive a confirmation message or email acknowledging that your Annual Report has been filed along with a receipt.

Remember to maintain copies for your records, and ensure future reports are filed by the required due date, typically the first day of the anniversary month of your business's formation.

What is the purpose of il annual report form?

The purpose of an IL Annual Report form is to provide information about a company's financial status, activities, and performance to the Illinois Secretary of State. It is a legal requirement for corporations, limited liability companies (LLCs), and other business entities registered in the state of Illinois to file an annual report with the Secretary of State's office. The report includes details such as the company's address, registered agent, officers, directors, and any changes to the business structure or ownership. It helps the government and public to ensure transparency and compliance with state regulations.

What information must be reported on il annual report form?

The exact information required on an Illinois annual report form may vary depending on the type of business entity. However, generally, the following information is commonly required:

1. Entity Information: The name of the business entity, its principal place of business, and its identification number or file number.

2. Registered Agent and Office: The name and address of the registered agent, who serves as a point of contact for legal documents and notices, and the registered office address.

3. Officers and Directors/Managers and Members: The names and addresses of all officers, directors, managers, and members of the business entity, as applicable.

4. Principal Business Activities: A description of the principal business activities conducted by the entity.

5. Business Address: The main address where the business is carried out or the headquarters are located.

6. Shareholders or Partners: The names, addresses, and ownership percentages of shareholders or partners, if applicable.

7. Authorized Shares: For corporations, the number of authorized shares and any changes made during the reporting period.

8. Fiscal Year: The fiscal year-end date of the business entity.

9. Signature and Date: The form must be signed by an authorized individual, such as a director, officer, or member, and dated.

It is important to note that the specific requirements may vary based on the business type, such as corporations, LLCs, partnerships, etc., so it is advisable to refer to the official Illinois Secretary of State website or consult with legal professionals for accurate and up-to-date information.

What is the penalty for the late filing of il annual report form?

The penalty for late filing of the annual report form in Illinois varies depending on the type of entity:

1. Domestic and Foreign Corporations: For-profit corporations and nonprofit corporations both face a late fee of $300 if the report is filed after the due date.

2. Limited Liability Companies (LLCs): LLCs in Illinois have a late penalty of $100 if the annual report is filed after the due date.

It is important to note that these penalties are subject to change and it is advisable to check the Illinois Secretary of State's website or consult with a legal professional for the most accurate and up-to-date information.

How can I send il annual report form to be eSigned by others?

Once your illinois lp 210 form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make changes in illinois limited partnership act?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your illinois limited partnership annual report to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit il annual report pdf on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign illinois uniform limited partnership act on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your il annual report form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Illinois Limited Partnership Act is not the form you're looking for?Search for another form here.

Keywords relevant to il lp210 form

Related to illinois limited partnership form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.